The risk dial is decidedly in the red today with global stocks taking a beating, commodity prices weaker, bond yields sharply lower and the USD generally stronger. Focus has been on the Delta variant and its spread across south east Asia which is concerning investors about renewed lockdown measures.

It is also a very quiet week data-wise and markets feel like summer is well and truly upon us. Trade volumes are thin with low liquidity and little activity which may persist for the next few weeks through the summer. This is a recipe for exaggerated moves as the risk backdrop becomes the main driver for markets over the next few days.

Oil deal sees weaker crude…for now

The major news from the weekend was the calling of a snap OPEC+ meeting given last week's agreement between Saudi Arabia and the United Arab Emirates which patched up the rift blocking the OPEC+ deal. Ministers agreed to increase oil supply from August by 400k barrels per day to cool prices that had climbed to the highest in around two and a half years. This should now give comfort to the market that the cartel is not splintering in disagreement and will also not be opening up the production floodgates anytime soon.

Although the pandemic is still rampant, oil demand is strong and the market remains tight. Brent prices are trading right on the March high at $71.36 with support below here at the May highs around $70.22. Bulls will want to get back above the 21-day moving average to stop much further downside. On a longer-term chart, we can also see a support zone that held 2019 and 2020 swing highs.

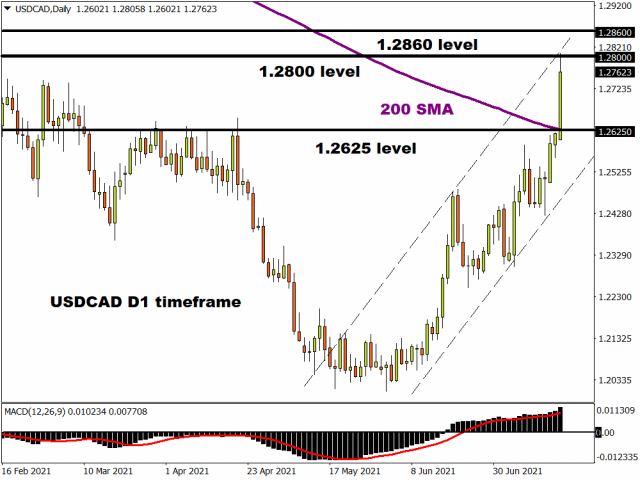

USD/CAD bursts higher

CAD is the worst performing major currency on the session with weaker stocks and crude oil hammering the loonie. Any positive news around CAD like the fact that Canada has now overtaken the US in vaccination rates is being overlooked with USD/CAD surging higher. At one point, the pair was trading above 1.28 and although it has pared gains, the break through the 200-day SMA offers strong support around 1.2625. We are overbought on the daily RSI so should see consolidation with bulls targeting the 1.30 area in the long term.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.