US stocks are consolidating at the recent record highs, in a holding pattern as traders await the next reason for pushing higher. Bank earnings once more showed blockbuster numbers driven by the investment banking side, with Blackrock, the world’s largest asset manager, reporting a 16% jump in first quarter profit as investors poured more money into its diverse funds and fee revenue jumped.

Bullish momentum is starting to appear after pausing this morning with traders awaiting the next leg higher. Markets are getting more comfortable with the Fed’s go-slow policy adjustment stance with the big prints this week in the economy not likely to upset the apple cart and so push stocks further into new territory.

No love for the buck even with decent data

The muted dollar reaction so far to bumper US retail sales figures and falling jobless claims mirrors the reaction after the March inflation data earlier in the week. Instead of helping the greenback, the decent US numbers are supporting pro-cyclical FX like the Kiwi and Aussie which is pushing both currencies nicely off their recent lows. As stimulus continues to feed through and yield support fades, we should expect this week’s theme to continue to play out over the next few weeks.

Single currency hits resistance zone

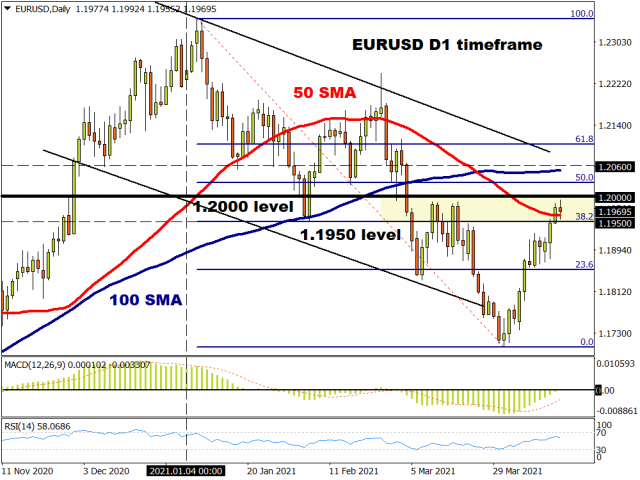

EUR/USD’s tentative recovery, in part all down to the weaker dollar, is closing in on the 1.20 psychological level. However, there’s a confluence of resistance around 1.1950/90 which includes the mid-March highs at 1.1990, an important Fibonacci level (38.2% of the entire 2021 fall at 1.1950) and the 50-day moving average at 1.1974. If that doesn’t stem the tide, the 100-day moving average looms just above at 1.2060.

Positioning adjustment may help the pair higher, but the ECB meeting next week will also garner attention for any hints on whether the bank will go back to a slower pace of asset purchases in its emergency bond buying programme.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.